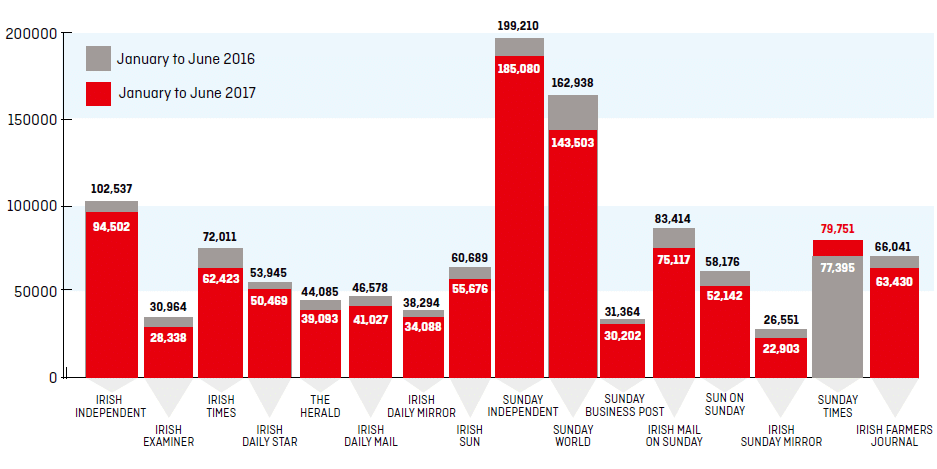

The latest national newspapers Audit Bureau of Circulation (ABC) report for Irish newspapers bring more bad news for the industry, with a drop in total sales of over eight percent – over 90,000 copies – in the twelve months to the end of June 2017.

At the top end of the market, the Sunday Independent saw a fall of 14,140 copies (7%), while the daily edition of the Irish Independent dropped by 8,035 (7.8%), and now finds itself below the psychologically important 100,000 copies mark, at 94,502 copies daily. The Irish Times dropped even further, losing 9,588 copies (13.3%) leaving it with 62,423. Meanwhile the Sunday Business Post (down 3.7%) is barely over 30,000 copies daily, (in addition, the Business Post has 1,100 online subscribers) and the Irish Examiner has fallen 8.5% to 28,338 copies. Earlier this year, it was reported that Independent News and Media (INM) was looking at purchasing the Examiner, and the Sunday Business Post reported in August that the Irish Times was considering the same purchase, so it may be that the Cork newspaper’s days as an independent publication are numbered. It is difficult to see why either IN M or the Irish Times might want the Examiner itself, except possibly to block a competitor from acquiring it, but Landmark Media does also hold several provincial titles and local-radio shareholdings. As Warren Buffett is demonstrating in the US, even in a declining market, such titles can still be profitable, given sufficiently ruthless cost-cutting, a process euphemistically described as “managed decline”.

The picture looks no better among the tabloids, with both native and imported titles losing print sales. On Sundays, only the Daily Star Sunday (up 299 copies (2%) to 15,366) and the Sunday Times (up 2,378 copies (3.1%) to 79,833, and overtaking the Mail on Sunday) buck the trend. The Sunday Times boost may be due in part to the publicity over their launch of a new daily digital edition for the Irish market, although there are other factors at play too, such as an increase in bulk sales over the period. Daily figures are also striking for the Times, gaining 1,142 (44%) to grow from 2,587 to 3,728, again with an increase in bulk copies contributing to the increase. However, as the new Ireland edition didn’t launch until June, it will not be clear whether this has had a longer-term impact on sales and digital subscriptions until at least one full survey period has elapsed.

Meanwhile, the Independent trails in digital subscriptions, with 1,900 in the first half of 2017. This compares to the Irish Times, which even with its (extremely porous) paywall, claims 15,000 digital subscribers, up from 9,800 a year earlier.

In February 2015, as the Irish Times prepared to launch its paywall, this column calculated based on the website’s then monthly unique visits that it could expect to attract around 17,500 digital subscriptions, based on typical conversion rates in other markets.

The Irish Times is now close to that number, but since then, its unique monthly visitor numbers have grown from 3.5 million to over 8 million monthly users, according to its advertising data. Some measure of this will consist of duplication across different machines (a single user could view the site at different times of the day using any of a work PC, a laptop, a smartphone, and a tablet), and there are no clear data on the degree of duplication, but allowing for those caveats, the maximum- digital-subscription target would seem to lie at around 40,000. Whether this target is actually achievable remains to be seen. To put the Irish Times figures in context, when it decided to go with a paywall in 2015, the Irish Times circulation stood at 76,194 copies. In the first half of that year, it sold 4,853 copies of the digital edition. Losing just short of 14,000 print copies while gaining roughly the same number of digital subscribers may seem like holding steady, but the associated digital revenues from subscribers and advertisers are unlikely to make up for the loss of more lucrative print revenues. To an extent, the shift to digital readership represents cannibalisation, as readers switch from expensive print to cheaper online subscriptions. But even so, the Irish Times would seem to be at the head of the pack in chasing online revenues.

The Irish Times’ performance is even more remarkable considering that US metro titles which have achieved similar digital conversion rates are usually the sole newspaper in their markets, while Tara Street competes against the Independent, Examiner, and other titles, as well as RTÉ and TheJournal.ie online.

No matter how many digital subscriptions they attract, newspapers still have to make up ground lost along the way, and that means developing new content streams. The Irish Times again appeared to be at the head of the pack here, developing several branded podcasts covering politics (both domestic and international), business, culture and travel. The Examiner podcasts are few and far between, focussing on sports. The Independent podcasts lean heavily to sports, with dedicated GAA and League of Ireland shows, in addition to general sports, politics, and business, and The Women’s Podcast.

Both websites carry one-on-one podcasts shows, the Independent version hosted by Paul Williams, while the Irish Times has Roisin Meets, with Roisin Ingle. With the exception of the last two shows, however, there is a sameness to the product, which mostly consist of panel discussions among (mostly) journalists from each of the titles. Curiously, considering the medium, the only Tech podcast is the Connected podcast from the Sunday Business Post.

The fastest growing podcast segment in the US is the morning news podcast. So far, Irish podcasting still operates on a weekly schedule, reluctant to take on the Morning Ireland behemoth.

Nicholas Quah, editor of the Hot Pod, a weekly newsletter covering the developing podcast industry, has developed a “taxonomy of podcasts” which he uses to frame discussions on how the medium is evolving. The first category, the “gabfest” or conversational podcast, covers most Irish podcasts by established newspapers. It has the advantage of being deceptively easy to set up (a room, some microphones, and a topic), but difficult to do well or to scale. Closely related is the interview podcast, a one-on-one conversation. Between them, these two categories account for most Irish podcasts, not just by the legacy newspaper sites but by newer entrants such as Headstuff and Castaway Media. Perhaps not surprisingly, the format also accounts for most of the spoken-word output on RTÉ and Newstalk.

At the other end of the sale is the documentary podcast, a usually in-depth look at a particular topic, inquiringly reported and heavily produced. It can vary from light-to-medium magazine-style features to hard-news investigative pieces such as those produced by Pro Publica, an American non-profit journalism website. In between those extremes can be found the news-magazine format, usually telling several shorter stories within a single show through a mix of interviews and documentary-style packaged reports, the “explainer”, going in depth to cover the fundamentals of a particular topic or story, and the local podcast, covering a defined community.

But perhaps the fast growing new podcast segment is the morning news podcast. In the US market, two products have emerged in this category in the last year, The Daily from the New York Times, and Up First, from NPR. So far, Irish podcasting operates on a weekly schedule, and it might seem unlikely that any news outlet would consider taking on the Morning Ireland behemoth directly. But a short morning podcast covering one or two of the major overnight stories, or even setting out the news diary for the following day, could be a niche news product offering a different take on current event (and one which doesn’t have to adhere to BAI broadcasting regulations).

Curiously, similarly-themed products, aimed at giving a quick news round-up and a preview of what’s likely to dominate the headlines in the coming 24 hours, have also grown in popularity in the last year in other markets, and in a format many commentators were predicting was becoming obsolete.

Email – or more specifically, email newsletters – are proving to be a powerful way to generate web traffic, and in some cases can send more readers to websites than even Facebook.

The medium has the advantage of being requested by subscribers, and so is wanted when it hits Inboxes, unlike uninvited phone notifications and pop-ups. And it is flexible, offering the possibility of everything from daily briefings to in-depth coverage and alerts covering specific stories and news beats. The Irish Times, Independent and Examiner all offer email bulletins, with various degrees of specialisation. Given the opt-in nature of the medium, email offers news outlets a way to provide advertisers with highly individualised targeting for their messages.