A situation is unfolding in the Northern Ireland Royal Courts of Justice, which calls into question the integrity of the Administration of Justice, the right to a fair hearing and fair procedures on which the entire system depends. It is the worst-kept secret in legal circles in Northern Ireland, and yet not one media organisation has chosen to run the story.

On 9th March 2017 Justice Mark Horner, a well-regarded judge who is best known for a recent liberal judgment on abortion rights in the North, was asked by a litigant-in-person to recuse himself from a case involving Bank of Ireland (UK) Plc as it had been brought to the litigant’s attention that Justice Horner had a serious conflict of interest which he had failed to bring to the court’s attention at any stage while he sat as Judge on the case.

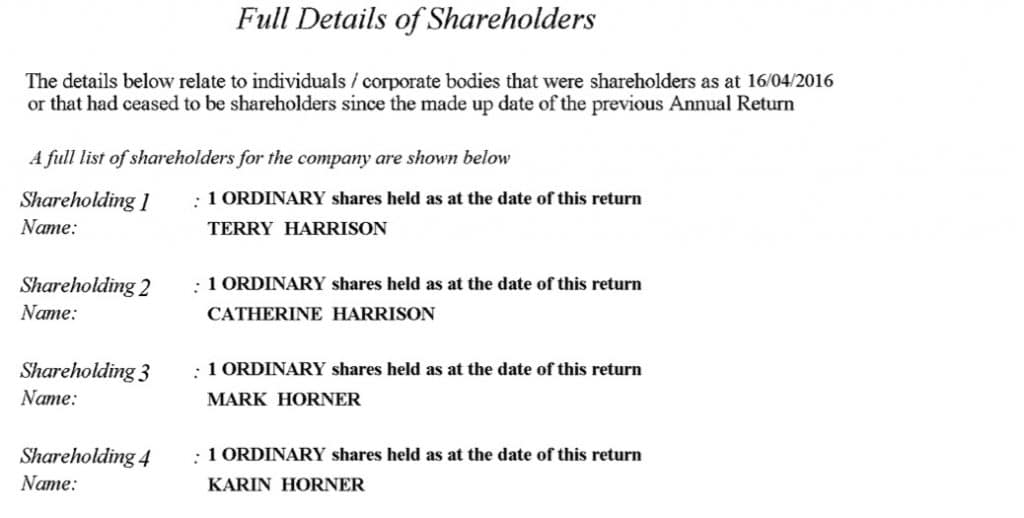

Justice Horner was a Director up until late 2011 and is currently a shareholder in TMKK Limited, which was a financially-troubled client of the bank.

On 14 March the litigant-in-person made an official complaint to the Lord Chief Justice’s Office and has yet not received a substantive reply, as the Office seems wrongfooted. The Lord Chief Justice’s Office seems nowhere close to convening the Tribunal envisaged in the Code of Practice on Judicial complaints.

On 27 March Justice Horner recused himself from the litigant-in-person’s case giving a statement saying that the reason he recused himself was because the litigant in person would not accept his judgment. This is judicial nonsense. No judge ever should doubt the acceptance of his judgment by a party.

The Lord Chief Justice’s Office told Village: “Mr Justice Horner stated in open court that he was recusing himself in the case involving the Bank of Ireland and the personal litigant. He said he was satisfied that there was no question of actual bias or that he had any conflict of interest in the case, but that it was apparent to him that ‘the party would never feel able to accept [his] verdict’”.

On 4 April in a separate case involving the same plaintiff i.e. Bank of Ireland (UK) Plc, the bank itself, presumably sensing the dangers of compromise and appeal, actually instructed its own QC, Patrick Good, to request that Justice Horner recuse himself from that case. Horner had little choice but to stand down from this case also.

The same legal firm, C & H Jefferson now DWF, represented the plaintiff, Bank of Ireland (UK) Plc in both cases described above.

It is obvious that the plaintiff was aware of the conflict of interest with Justice Horner as the judge had for many years been a director and is currently a shareholder in TMKK Limited which was a client of the bank. However, neither the bank nor its legal team made the court aware of the conflict, though as solicitors are officers of the court, it is normally their duty to do so. The solicitor who acted for the plaintiff in both cases seems not to have fulfilled that duty. She is no longer acting for her firm in either of the cases.

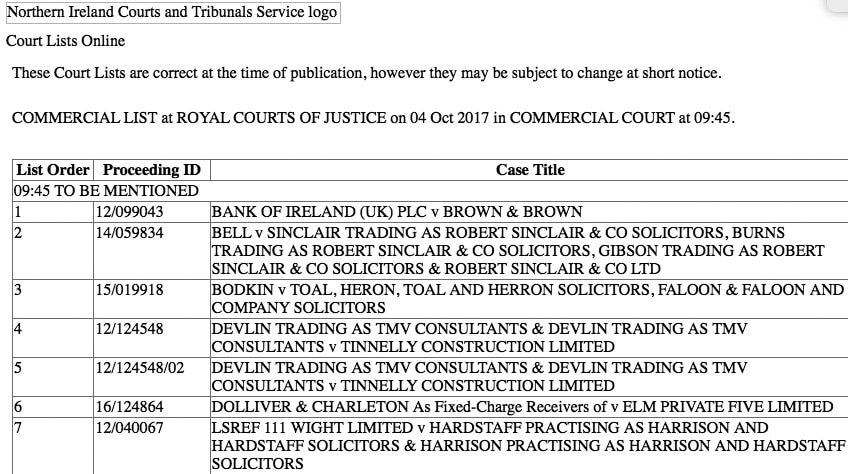

After that Justice Horner stopped sitting on any cases involving Bank of Ireland in the Chancery court but moved to the Commercial Courts in September and has sat on a number of Bank of Ireland cases. On 4 October 2017, as Village was going to press, a Bank of Ireland case was listed in the Commercial Court [image A, 1] (Interestingly another case was listed for the same day (not involving Bank of Ireland) where the defendant is the current master of the High Court in Belfast, Ian Thomas Hardstaff, who was in partnership with the Harrison referred to in the list who is still a shareholder and director of TMKK Limited) [image A, 7].

Moreover Justice Horner also has dealings with The Northern Bank Ltd through TMKK Limited. Here too he sat on many cases and did not inform the parties of this.

The defending party in one such case is aware of his recusal in the two Bank of Ireland cases. That defendant is currently appealing a case involving Northern Bank Ltd in which Justice Horner gave a judgment against them. They brought his conflict of interest with Northern Bank Ltd to the Appeal Judges’ attention and the court remitted the matter back to the Chancery Court as it is the appropriate court to determine such matters.

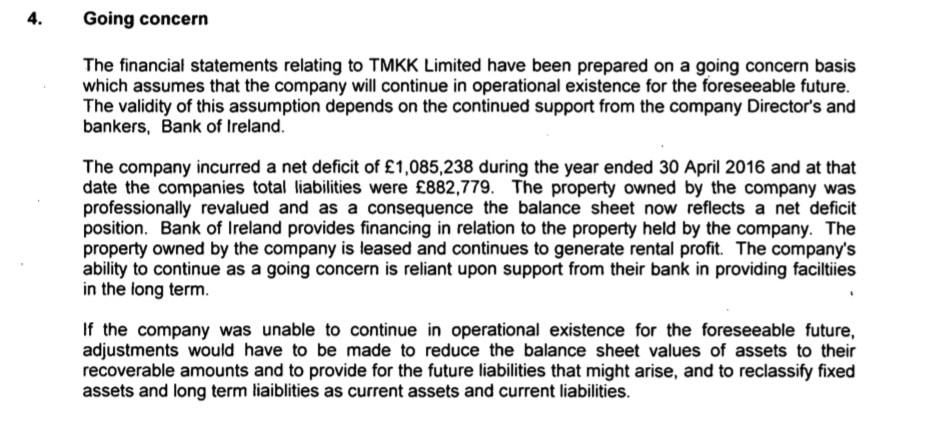

Justice Horner resigned as a Director of TMKK Ltd before applying for appointment to the High Court – though he and his wife both remain shareholders. Indeed his wife replaced him as a Director. Relevant accounts (page 144 section 4 [image A]) for TMKK Ltd available from the Companies Office show that it is indebted to Bank of Ireland and Northern Bank (now Danske Bank). However, much more dramatically the company is insolvent. The final paragraph of the accounts entitled “Going concern” [image B] clearly states that TMKK Ltd is only trading at the discretion of Bank of Ireland.

By any standard this Judge should not be hearing any cases involving Bank of Ireland. He has immense power and has given possession orders in favour of Bank of Ireland and Northern Bank while he has been seriously conflicted. This could have involved both commercial properties and family homes. All of his cases are on public record.

Anyone who has had a case under Justice Horner involving Bank of Ireland or Northern Bank Ltd/Danske Bank may be able to have their judgment set aside due to failure to disclose a serious and fundamental conflict of interest.

The Lord Chief Justice’s Office notes that while the judge may be considering Queen’s Bench actions which are listed for mention he is not now “adjudicating on any commercial or Chancery cases involving the Bank of Ireland”.

The Lord Chief Justice’s Office said it was “unable to comment further as the Justice (NI) Act 2002 provides information on complaints on judicial office holders is confidential and must not be disclosed except with lawful authority”.

Thousands of families across Ireland both North and South are fighting for their homes and properties in the Court system. They need to know that they are getting a fair hearing and that justice is being seen to be done.

CODE OF PRACTICE ISSUED BY LORD CHIEF JUSTICE UNDER SECTION 16 OF THE JUSTICE NORTHERN IRELAND ACT 2002: COMPLAINTS ABOUT THE CONDUCT OF JUDICIAL OFFICE HOLDERS

4.7 If the complaint is within the remit of this Code, the complaints officer will acknowledge receipt of the complaint. The complaints officer will then ascertain whether the Lord Chief Justice considers that the complaint is ‘serious’. To enable the Lord Chief Justice to determine whether a complaint is ‘serious’, the complaints officer may have to conduct some preliminary inquiries. Guidance on the type of complaint that is likely to be considered serious is attached at Annex C. If the complaint is not serious and concerns a tribunal member, it will be passed to the President of the appropriate Tribunal to be handled according to the procedure set out at Part 12.

Actionable conduct

- Conduct which is likely to bring the judiciary into disrepute.

- Conduct which calls in to question the judicial officer holder’s ability to properly administer justice, whether by perception or otherwise.