General election 2016 rose up with a bang and ran out with a sizzle. Days before the voting started and well before the results were known, two simple facts of life took hold over anyone’s rosy expectations for the future as heralded by the political campaigns – Left, Centre and Right – of the imaginary political spectrum that demarcates the insular and parochial Irish intellectual milieu.

Firstly, virtually every party and every candidate, save for a handful of disparate voices, have now moved into Celtic Tiger 3.0 mode: promising lower taxes, more spending and a perpetual and forever-strengthening recovery.

Secondly, GE 2016 lacked policy ideas about as much as the Sahara Desert lacks rain. Fianna Fáil and Fine Gael. Again. But now together.

The Governing Coalition chose to do address its electorate from the perspective that policy continuity and stability (read: predictability) are the key drivers for future success. The challenging and challenged Centre-Left, led by FF, took to a traditional Irish oppositionalism, shouting loudly: “Not enough being promised and even less delivered!”. Sinn Féin opted for the complacent and comfortable “We are not them, but we promise even more” line.

On the fringes of the spectrum, where smaller parties and the Independents struggled to get their voices out, there were ideas, debates, ideologies, ideals and un-Irish (at least according to the political elites’ metric of authenticity) integrity and passion. This was the small planet where oxygen owed, orbiting the Death Star of the status quo.

But the planet was not big enough or perhaps the oxygen just inadequate. And it was not aided by the analysis coming from ‘outside’ the politics tent some-where deep within. Thus analysts who are academic and unaligned (at least ostensibly) opted to apply their usual policy models to the raw ideas often advocated by the newer political groups. On occasion this analysis was outright partisan, slating and praising similar proposals based solely on which party was doing the proposings. At times, things got ad hominem; at times: hysterical. An example of the latter was a research note from one of Ireland’s premier asse-management companies shouting about the risks of political instability that could be visited upon the Irish economy should the current Coalition be supplanted by a weaker form of Eurogroup parrot.

Amid all this low-brow circus, few analysts and even fewer political leaders bothered to notice just how out of touch with the modern reality Irish politics has become. A country of 4.8 million people, drained of its power to influence the course of Europe and self-deprived of its will to chart an independent economic policy in the style of, say, Switzerland or even Denmark or Holland, Ireland is now navigating the high seas of global economic fortunes, rudderless.

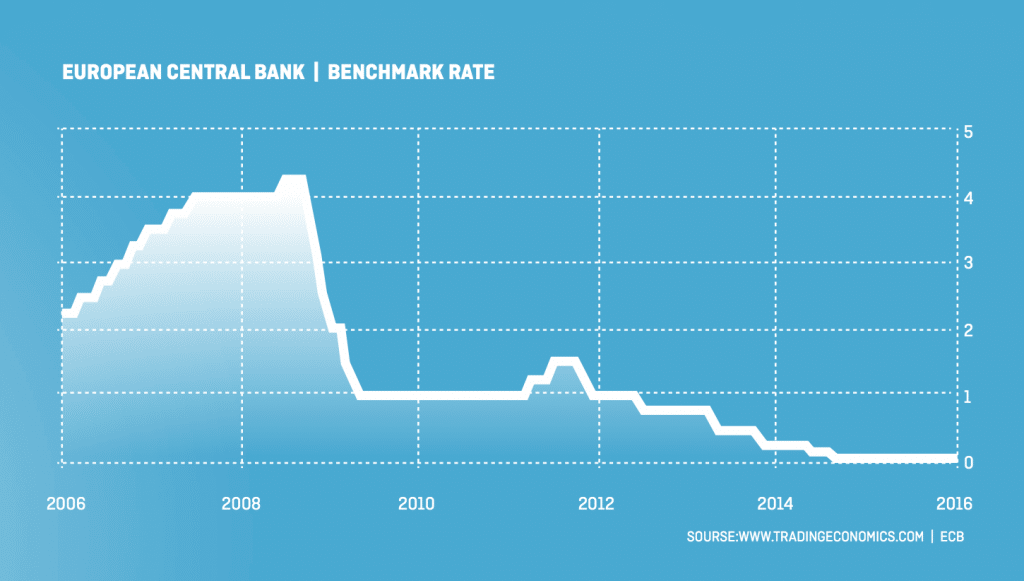

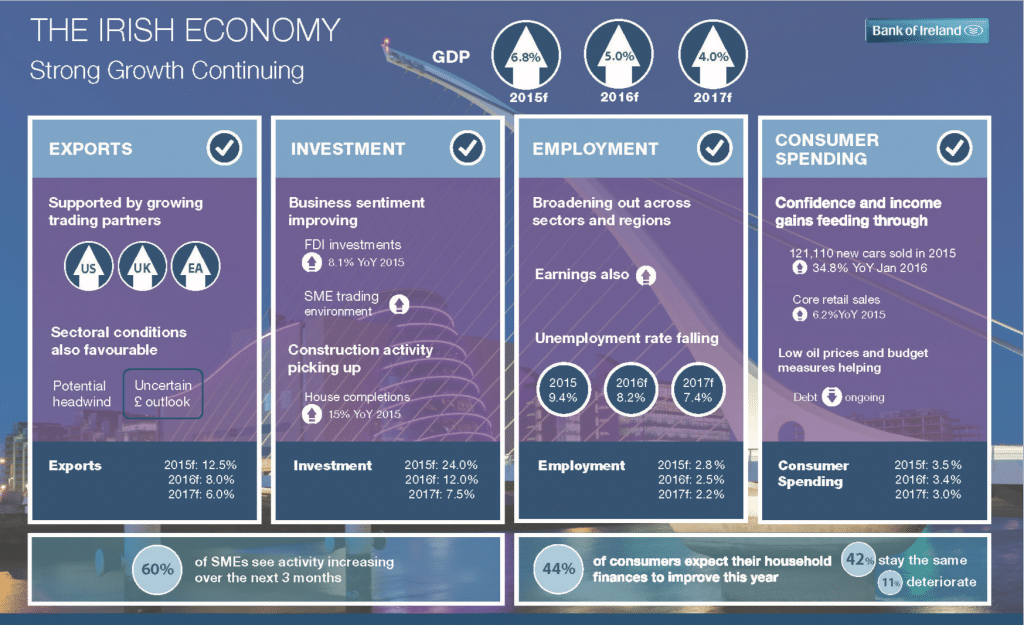

As noted passim during the ‘leaders’ debates of General Election 2016, over half of the Irish recovery miracle of 2014-2015 was passed down to us from high Frankfurt’s ECB offices. Euro devaluation, negative government-debt yields, ample bank liquidity and historically low interest rates. Together the beneficence of serendipity has sustained our exports, kept in check our imports, underpinned the temporary solvency of our banks and maintained a cap on mortgages and SME-debt arrears. About a quarter of our Celtic Phoenix story has been written by the US Fed and the eternal (we hope) dysfunctionality of the US taxation regime that enabled both strong demand for Multinational (MNC) production off-shoring from, and exports on-shoring into, North America from Ireland, while at the same time doing zilch to reduce the stonking incentives for Ireland-bound tax inversions. Having swallowed a propaganda pill of recovery, Irish consumers underwrote the rest of our growth, pushing up domestic consumption and forgetting (for now) the gargantuan rock of debt still hanging around their necks.

Alas, the problem with the Celtic Phoenix – the very foundation of the Government’s ‘continuity = recovery’ thesis and the opposition’s ‘tax-less-spend-more’ proposition – is that its existence owes nearly everything to what happens outside the Dail and Merrion Street. Having ignored the changing world around us, our political elites have not only confirmed their provincial and insular nature, but put at risk Ireland’s economy and society. This will become evident in the next year or two. Let me explain why.

Recent media and pundit coverage of the global economy, and of advanced economies, has focused on the rising degree of uncertainty surrounding growth prospects for 2016 and 2017. Much of the analysis is weak, tending to replay the clichés of the risks of ’monetary policy errors’, ‘emerging markets rot’, and ‘energy sector drag’. But the real four horsemen of the economic apocalypse are loudly banging on our castle gates.

These four horsemen are:

1.Supply-side secular stagnation (technology-driven productivity growth slowdown);

2. Demand-side secular stagnation (demographically driven slump in global demand);

3. Debt overhang (the legacy of boom, bust and post-bust adjustments); and

4. Financial fragility(the risk of a major crisis brewing within the highly interconnected and interdependent global financial system).

In this world neither monetary nor fiscal policies, defined within the constraints of traditional practices, work. Neither supply-side nor demand-side economics hold any serious answers. To see this consider Japan. By Keynesian standards, the country with Government debt at 248 percent of its GDP should be a roaring success. All of this stimulus should have produced at least a speck of sunshine on the dour growth horizon. And by monetary policy standards, Japan should be a roaring success – the Bank of Japan is now running negative interest rates, having pioneered zero-bound rates in February 1999. It has a balance sheet (a metric of quantitative easing) of 76% of GDP. Alas, latest forecasts put growth projections for Japan at 1% in 2016 and 0.45% in 2017. This is the equivalent of firing up a nuclear reactor to get kettle boiling.

Next, consider the ‘stronger’ economic fortress, the US ,to whose fortunes Ireland is hip-linked through our (er… not quite OUR) exporters and investors. Here, the Congressional Budget Office’s latest forecast is that tbe budget deficit will rise from 2.5 percent of GDP in 2015 to 3.7 percent by 2020. None of this deficit expansion will result in any substantive investment in the economy, because most of the projected budget-deficit increases will come from the higher cost of servicing the US federal debt. Key drivers of the upside that would occur because of the reduction in the cost of debt include: increasing debt levels and interest rate hikes. Actual discretionary spending that is approved through the US Congress votes, excluding spending on entitlement programs (Medicaid, Medicare and Social Security) will go down, from 6.5 percent of GDP in 2015 to 5.7 percent of GDP by 2020. Now, remember – following the crisis, the US economy has delivered the largest deleveraging of all G7 countries. Still, the debt pile is too large to carry without suffering the consequences.

Which proves that debt overhang is a bitch, even if Keynesianists and Irish politicians think it is just a cuddly puppy… Claudio Borio of the usually conservative and staunchly pro-status quo Bank for International Settlements (the Central Bankers’ Central Bank) agrees. In a major speech last month, Borio summed up the “symptoms of the malaise” afflicting the global economy: excessive debt, slow productivity growth and lack of policy-manoeuvre room for fiscal and monetary authorities. Readers will not have heard any of this from the Irish ‘leaders’ debates or read it in political parties’ pamphlets. Borio’s research shows clearly how growing debt levels in the global corporate sector are now stifling growth in corporate profitability even before the majority of Central Banks are forced to reverse their policies and switch toward rate-normalisation, Fed-style. The key to Borio’s work is that the idea of restarting the global (or indeed European) economy by launching into a new credit boom on the back of low interest rates and other monetary- policy supports is not only ineffective, but is, in fact, counter-productive. Yet the idea of credit- fuelled growth is at the heart of both the European (ECB) and Irish political elites’ world-view. Worse, based on the IMF’s position outlined during the latest G20 summit in February it too is aligning with the same theology of debt. In its pre-summit position paper, the IMF called for expanded government spending (funded by new Government debt) to support already-expansionary monetary policies to boost global economic growth.

Faced with the four horsemen of the apocalypse, Irish politicians across the entire political spectrum have unanimously opted to ignore the bleak realities of the risks faced by the global economy, by Europe, by the US and, indeed, by Ireland. Instead of dealing with the necessary reforms of economic, political and social spheres, Irish parties of the Left and the Right have largely spent the General Election 2016 arguing who can leverage current growth numbers more to deliver a greater boost to public expenditures and subsidies, while producing deeper cuts to tax burdens. The aviary the of Celtic Phoenix has own the coop. The circus of Celtic Tiger 3.0 has arrived. And predictably, no one wants to hear the bad news. Again.

Constantin Gurdgiev