The erudite, scrupulous, good-natured and occasionally humorous Nama-scrutinising blog disappeared before its anonymous author could be traced, or tire – Kyran Fitzgerald

Namawinelake.ie’ website is no longer open for new wine. “Concrete has now been poured into the website”, its final entry reads, though existing posts will subsist. This is a great geekish disappointment to those who have followed the fortunes of the country as it seeks to recover from the financial heart-attack it suffered in 2008 following many years of reckless gambling and over-consumption.

Those prepared to draw sustenance from ‘the winelake’ were offered important insights into a grandiose world, the world of the well connected, the movers to whom the rules apply almost on a grace-and-favour basis. The site came into being three-and-a-half years ago, as the country embarked on one of the most extraordinary experiments in world economic history following the 2008 crash.

Ireland first took part in an initial ‘boiled frog’ experiment from around 2002 as the economy slowly began to overheat on the back of a lending bubble that seemed to occur underground like one of those Icelandic volcanoes. By the time the lava was apparent to those who troubled to look, it was already too late. Had it existed, the ‘winelake’ might have staunched the scorching flow. Instead, when it cooled, it collected it. As wine. Somehow.

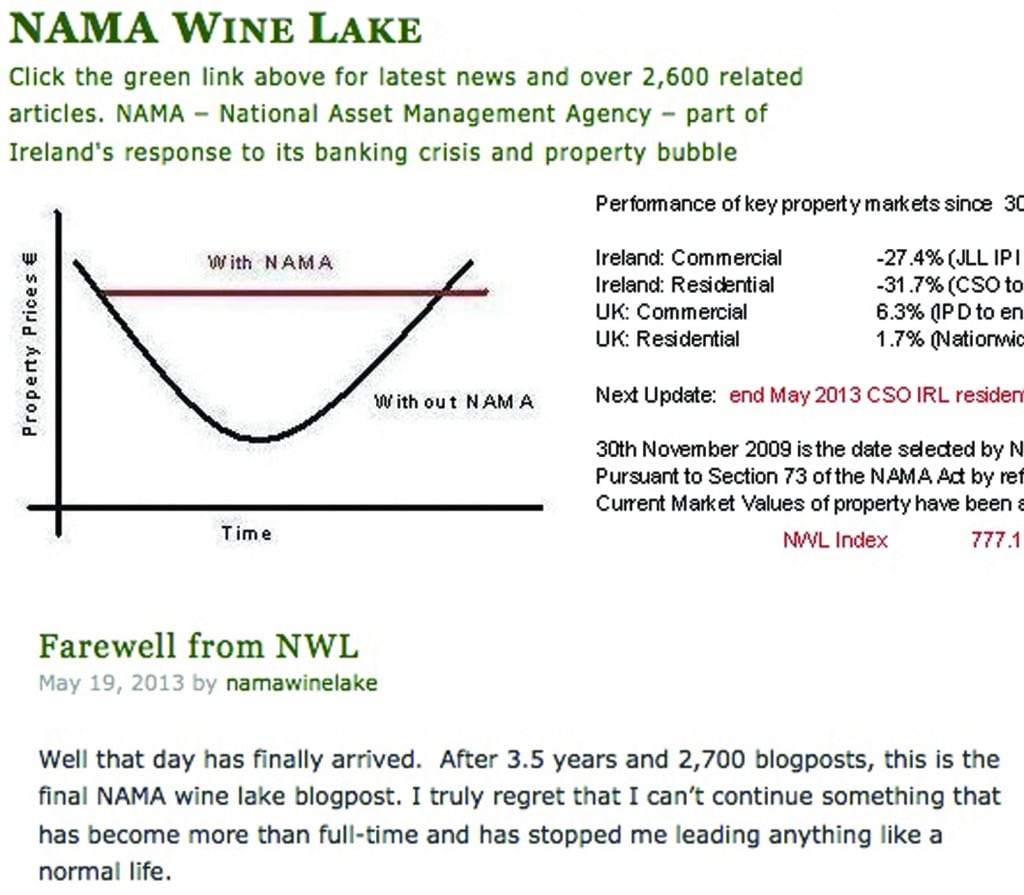

After the crash, the Government derived the idea for NAMA, the National Asset Management Agency. Wexford-based economist, Peter Bacon, is credited with coming up with the idea. It remains to be seen whether a statue will be erected in his honour when NAMA eventually is wound up.

Loans – with a book value of €72bn – were acquired for €30bn by the state through the new agency in what amounts to a huge gamble on the long-term future of the Irish property market.

Those in favour of the concept argue that the alternative would have been an even more disorderly collapse in the Irish property market and a total wipeout of bank depositors, but supporters of the free market maintain that a wiping clean of the slate would have allowed for a more natural rapid recovery in the economy as investors were attracted in droves by rock bottom prices.

Namawinelake came into being soon after NAMA’s formation at the end of 2009. It soon was performing a vital watchdog function. If initially the focus was on the operations of the agency itself, that focus was soon widened, extending in particular to the activities of the soon-to-be-nationalised banking sector.

But the website also began to monitor the activities of the businesspeople who owed large amounts to the financial institutions. It began to target the attempts of officialdom to duck questions about the manner in which organisations such as NAMA and the IBRC, the merged INBS and Anglo, were dealing with debtors.

Increasingly, the ‘winelake’ adopted the style of the cheeky chappy columnist, sugaring the diet with juicy titbits about the lifestyles of some of the people, mainly men, with whom NAMA and the IBRC had dealings.

It expressed ‘shock’ at the fact that NAMA had made a profit of just €132m on €2.7bn in sales up to September 30, 2011, of what were supposed to be some of the better-quality (predominantly UK) assets on its books

But the site managed to stick close to its core aims, one of which was to hold the powerful to account.

Questions continued to be raised about exercises in debt forgiveness, some of which were generous indeed, the burden for which must be borne ultimately by the taxpayer.

Namawinelake was not without the occasional blemish itself. Its reference, last November, to the ‘suicide’ of leading publican and property investor, Hugh O Regan was without doubt, uncalled for. It was the sort of error that experienced journalists simply do not – or should not – commit. It was a rare, but serious, lapse of judgement of a personal nature.

This writer has not been blameless in this regard, when it comes to discussing people’s personal difficulties, it should be added.

Questions have been raised about a leaning towards Sinn Féin and to its Finance spokesman, Pearse Doherty. One online critic counted 113 posts dealing with questions raised in the Dáil by Doherty, compared with just 35 posts covering questions raised by his well regarded-Fianna Fáil counterpart, Michael McGrath.

The disparity may simply be reflective of the fact that Sinn Féin’s young team cottoned on more quickly to the significance of the website and were feeding cleverly off the blog posts.

Eyebrows did arch at a Namawinelake blog heading of March 25, 2012: “Sinn Féin splits NAMA wide open with trenchant questions”. The blog, that day, raised some very interesting questions about Nama, nevertheless. In particular, it expressed “shock” at the fact that NAMA had made a profit of just €132m on €2.7bn in sales up to September 30, 2011, of what were supposed to be some of the better-quality (predominantly UK) assets on its books. And it had this to say about Nama’s relations with its ‘developer-clients’:

“We learn that although NAMA is prevented from selling property to defaulting developers, NAMA is allowed to sell property to its Qualified Investment Funds which can then sell the property to anyone, including defaulting developers”.

It also noted that ‘overheads’ to the tune of €55m had been approved for 41 developers.

If nothing else, the ‘winelake’ served to highlight the strange ‘carrot and stick’ relationship between the agency and its ‘clients’ which is based, at least to some degree, on mutual dependence.

NAMA itself is populated by a mix of hard working bureaucrats (Chairman Frank Daly and CEO, Brendan McDonagh) and property experts, most of whom played a not insignificant role in the years culminating in the popping of one of the world’ s largest ever property bubbles. This incongruity has only added to the fascination with NAMA which the ‘winelake’ tapped into so effectively.

Over the past three years, some developers have drawn closer to its bosom while others have been thrust out of the garden of Eden straight into the stony world of receivership and in many cases, bankruptcy.

Bystanders have been left to wonder on what basis some individuals have continued to retain the trust of the Agency, being paid fat salaries for their cooperation into the bargain while others have been cast out. What happened between NAMA and Johnny Ronan/Richard Barrett is a source of great curiosity.

The blog has also noted the lack of specific debt-reduction targets for NAMA and criticised it for a lack of specific provision for legal costs incurred in the course of the court challenge mounted by businessman Paddy McKillen.

Although NAMA is prevented from selling property to defaulting developers, NAMA is allowed to sell property to its Qualified Investment Funds which can then sell the property to anyone, including defaulting developers

McKillen would emerge as one of the stars of the blog series, over the period from 2010 to 2013, prompting some in the media – alternatively – to wonder whether he was providing some support to the ‘winelake’ project.

Certainly, the agendas of the website and Mr McKillen appeared at one when he brought his clarifying challenge to Nama’s attempt to gain control over his loans all the way to the Supreme Court, where he succeeded in two of four grounds of appeal against an earlier High Court decision. The website’s coverage of the drawn-out High court proceedings was lively and informative.

McKillen was, for ‘winelake’, the hero of the hour. His challenge helped to clarify much about NAMA and he was soon back at the centre of attention when he fought the Barclay brothers in the English High Court for control of a group of top London hotels. The twins had secured the backing of property investor, Derek Quinlan, holder of a key chunk of the Maybourne hotel group, which owns the hotels.

More recently, however, the ‘winelake’ has rapped McKillen on the knuckles, casting further doubt on paternity. It has highlighted the Ulsterman’s social side and his ownership of a 600-acre development near Aix-en-Provence called ‘Xanadu’ complete with sculptures by REM frontman, Michael Stipe.

Another businessman the ‘winelake’ paid great attention too was Denis O’ Brien. One can never accuse our richest indigenous Irish businessman of being boring and he has been the source of much copy for the ‘winelake.’

In April 2012, the ‘winelake’ had a look at Digicel, the global communications company which is the basis for O’ Brien’s current fortune. It examined the 2011 Transparency International rankings linking the findings with the Digicel operations in the Caribbean and Pacific regions. It pointed to Haiti’s ranking at number 175 out of 182 countries in the league table and lists five other countries including Guyana in 134th place , and Honduras, with ranking below one hundred. Jamaica, a major area of Digicel activity, comes in at 86th place.

More recently, Digicel has been actively scouting in Burma which is opening up to overseas investment. Burma ranked near the bottom in Transparency International’s 2012 league table. Of course, this may imply nothing more than that Digicel is forging ahead into virgin territory, rather like a business setting up stall in the 19th century America’s Wild West.

Last November, in proof it is not owned by O’Brien, the ‘winelake’ posed the question: why is Denis O’Brien not in NAMA? – referring to his large property-related loans. In a bit of mischief-making, it went on to suggest: “If Denis’s loans were acquired by Nama, then Denis would potentially face restrictions on his lifestyle. NAMA famously imposes a €200,000 cap on salaries to its developers. It does not look kindly on private aviation, and NAMA also bans charitable donations and sports sponsorship”.

Earlier, in August 2012, the ‘winelake’ praised the ‘brave defiance’ of Sunday Independent editor, Anne Harris – Harris had just published an interview with the former Chairman of Independent News and Media (INM), James Osborne, who had made the allegation that O’Brien had rung him to get an article withdrawn from the following day’s Sunday independent (this allegation has been denied by spokespersons for O’Brien).

More recently, and of more relevance to Nama-watchers, the ‘winelake’ questioned the loan write-downs agreed with INM, estimating the writedowns at €196m plus interest. As the loans were handed out by AIB and Bank of Ireland it pointed out that taxpayers were heavily on the hook.

In practice, such write-downs are now sadly the norm as far as much of corporate Ireland – at least, that part most exposed to the downturn – are concerned. It is argued that the obvious alternative to a write-down, a complete collapse of the group, might leave the taxpayer even more on the hook.

The ‘winelake’ itself acknowledged that INM had managed to produce an operating profit on its core business of €60m and an after-tax profit of €29m, something it regarded as impressive in the circumstances.

In July 2012, the elusive blogger took the Broadcasting Authority of Ireland to task for its conclusion that O Brien “does not control INM. It recommended that members of the BAI be called before the Joint Oireachtas Committee on Transport and Communications to explain themselves”.

‘Winelake’s real strength was in commentary and analysis rather than in straightforward muck-raking, suggesting that its key commentator or commentators were close to the action without necessarily having the Sam Spade qualities of classic muck-raking journalism in the mould of Private Eye or Le Canard Enchainé.

The End

The dénouement unfolded quickly, and with a sudden twist in the tail, late last month. The ‘winelake’ did at least experience the pleasure of incorporeally witnessing the sudden liquidation of IBRC, a company which had become a particular target, earlier this year.

The website questioned both the salary levels of IBRC executives and some of the deals reached by the company with individual borrowers. It turned out that they were not alone – down in Merrion Street, concern that the IBRC had developed a mind of its own seems to have grown.

It also had time to level a parting shot at Michael Somers, the former boss of the National Treasury Management Agency over an Irish Times interview he gave in which he lamented the way the IFSC was losing out due to heavy regulation. Somers also complained about the pay-cap in banking which, he claimed, had resulted in the loss to the sector of skilled people.

The ‘winelake’ showed restraint, confining itself to pointing out that “alas, Somers did not provide detail on the regulations which IFSC banks found unpalatable”. Perhaps the author(s) had grown weary of the daily grind or perhaps they had information that they were on the verge of exposure. In the words of Voltaire, “it is dangerous to be right in matters where established men are wrong”.

And so the blog delivered its valediction. “After three-and-a-half years and 2,700 blogposts, there are thousands of hours of original research on these pages”. The blogger confessed to being depressed at how little was actually reported in its pages on the goings on inside Nama. Frustration was expressed at the legislatively mandated failure by NAMA to provide details of individual sales. The blogger added that NAMA clearly welcomed the resulting lack of scrutiny as otherwise it would be “bogged down in the minutiae of constantly defending itself”.

It warned of the scale of the possible black hole should deflated current property values persist: “Most cynics say that NAMA is taking advantage of the convention to hide massive losses, but you can’t conclusively say that”.

“The estimate on here is that property underlying Nama’s loans have dropped by more than €7bn since NAMA acquired the loans, but that NAMA has written off less than half that because accounting conventions allow NAMA to estimate the future cash flow from loans and pay limited attention to the underlying property”.

“Will NAMA make a profit by 2020? Who knows? None of us has a crystal ball”.

And there follows what almost came across as praise for the people the Lake has harried for so long. “NAMA staff are criticised for many things…being petty, intimidating, vindictive …their service is criticised for being slow, not being commercial enough, dogmatic. These are points of view, of course. But what appears to be universally agreed – even by detractors – is that they are hard-working, honest, accomplished and making progress in what is one of the most high-profile and politically-charged organisations in a country that invented the term ‘gombeen politics’”.

Perhaps then the authors worked for NAMA themselves…