On the morning of January 8th, Sean Corkery stood in front of the assembled employees of Dell in Limerick and told them sincerely that the decision to close down manufacturing there, with the loss of almost two thousand of their jobs, “was only made last week”. How fortunate for him as Vice President that Dell had a brand-new manufacturing plant in Lodz, Poland, just waiting to take over the relocated operations. In fact, as everyone in Limerick knows, this move became inevitable in 2006 when Corkery was chosen to spearhead the development of the Lodz plant. Since 2007, when new Polish recruits were flown to Limerick to be trained, rumours of Dell’s demise have been circulating, culminating in January’s announcement.

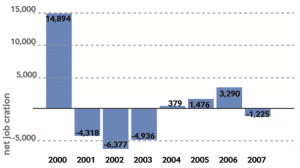

Dell has been very good for Limerick in the eighteen years since it opened its doors as the company’s first overseas plant. It came at a good time for the city, soaking up the human fallout from the departure of another multinational, Wang Laboratories, and taking on many of its recently redundant workers. Dell expanded rapidly, and by 2004 was Ireland’s biggest exporter. By 2007 it was contributing 140 million euro a year into the local economy in direct wages alone, and sponsoring many community initiatives as well as kitting out a local VEC secondary school to a world-class standard of IT capability. As well as manufacturing, Dell had several R&D and applications centres – almost a thousand high-quality technical jobs, considered less mobile than manufacturing ones. In fact, some of these R&D posts have also been lost in the current fallout.

Dell’s wages were high, and immensely important to Limerick, but amounted to less than a quarter of one per cent of the company’s operating income

The loss of two thousand jobs in a city the size of Limerick would itself be a body blow, but the situation is more serious than that. Dell has outsourced almost all non-core functions, from catering and security to the very cardboard boxes in which the PCs are shipped. Most of the companies handling this work have no other customer of any significance. Their jobs depend on Dell. And then are the local firms that benefit less directly – hotels, shops, schools, housing. Estimates vary, but conservatively, each Dell job supported three to four posts in other companies, which makes the impact of this announcement all the more devastating for the region. Dell often uses the word partnership to describe its relationship with Ireland, and it’s true that the relationship was mutually beneficial. Dell contributed greatly to the community. In turn, Limerick provided a first international operation, a steady stream of well-educated workers, no disputes and no scandals.

Dell’s wages were high, and immensely important to Limerick, but amounted to less than a quarter of one per cent of the company’s operating income for the year, less than one percent of Michael Dell’s own personal net worth. Ireland has always needed Dell more than Dell needed Ireland. There can be no partnership in the face of such inequality.

So how did Limerick and indeed Ireland become so dependent on a single company, on a decision made in a boardroom in Texas? Arguably it began in the seventies when our tax system was revamped to make us a more attractive location for foreign, particularly US, manufacturers. Our first strategy was completely to exempt exporters – overwhelmingly multinationals – from all corporation tax on their export profits. This was followed by a generous application of manufacturing relief, whereby profits on goods manufactured in Ireland were subject to a reduced tax rate of 10%. The assembly of imported components, the marking of commercial diesel and even the artificial ripening of bananas were all strangely deemed to qualify for the low tax rate.

The 10% rate fell afoul of the OECD’s rules on harmful preferential tax practices, and of a 1997 EU code of conduct on business tax which Ireland helped to draft. The problem with tax competition is that if it is successful – and Ireland was – the low-tax country sucks in more than its fair share of investment from abroad. Less successful competitors are driven into a race to the bottom in their own tax rates which can, in the case of developing nations, seriously impoverish them. The morality, as well as the efficacy, of this is at least ambiguous.

It is inevitable that “our” multinationals, having come here for fiscal reasons, will move on when costs rise.

In response to growing opposition, Ireland increased the rate to 12.5% and by widening its scope beyond manufacturing slipped passed the OECD’s ring-fencing tests and avoided being designated as a tax haven. It’s a difficult dance, but the low taxes have at least succeeded in their stated aim of drawing in investment. At the peak of the Celtic Tiger, in 2004, Ireland was the most profitable place in the world for a US company to operate, and was the world’s leading producer of software, over 90% of which was exported from Ireland by multinationals rather than Irish-owned firms.

The policy of using our tax system as bait to draw in investment had clearly worked, but at a cost. Leaving aside the difficulties caused in developing countries by our competitive practices, and the systematic shaping of our tax system to the needs of multinationals rather than small local firms, the policy carried within it the seeds of its own downfall. The strategy works best on those firms most willing to relocate in search of a lower tax rate. It is predictable then that these firms will be the first to move for a lower cost-base. Multinationals breed prosperity, which in turn drives up costs. It is inevitable that “our” multinationals, having come here for fiscal reasons, will move on when costs rise. To think otherwise is the economic equivalent of marrying a serial philanderer, and expecting a lifetime of bliss. This was never going to be a permanent arrangement. So the important question is, what is our Plan B?

One strategy the government has adopted for the last few years, once the writing on the wall became large enough for them to read, is to “move up the value chain”, to train scientists and engineers in the hope than large R&D facilities will replace manufacturing. The idea has some merit, but there are three major difficulties. First, it’s not for everyone. The idea that the vast bulk of school-leavers will go on to study science and engineering and work in R&D is patently ridiculous. Secondly it may not work.

Many of the recent job losses in Dell were in R&D, precisely the sort of thing that’s supposed to anchor a multinational in Ireland. Thirdly, if we really are to enter a knowledge economy, ignoring the fact that we come decades behind such countries as Finland, where is the investment in education? How does this sit with education cuts such as the slashing of third-level funding, quietly announced on the same day as Dell’s redundancies?

An alternative approach is to foster smaller, local industries which might be less mobile than multinationals. This cannot involve a return to De Valera’s dream of cottage crafts, and should not simply consist of outsourced, service jobs from our current batch of multinationals.

It does seem likely, however, that if Irish schoolchildren received the same exposure to entrepreneurship education as they do in, say, South Africa, many might plan to be self-employed or to start a small firm when they left school. This would certainly be more sustainable.

Government can’t take all the blame for the current situation, of course. Dell’s own Corporate Social Responsibility claims to put employees at the heart of issues. Sean Corkery in announcing the redundancies said: “We will treat affected employees with dignity and respect”. Perhaps including them in the planning for the last few years might have helped.

Either way it is a cold Winter, and thousands face unemployment in Limerick. Given the lack of creative thinking from government through all the years of boom, we cannot really expect a warm-Summer future.

Sheila Killian