By John Horgan

Is the writers’ and artists’ tax exemption scheme now on life support? Suspicions that this might be the case were first aroused when it was disclosed last year that a review of this scheme instituted by Finance Minister Michael Noonan last year had “abolition on the table”.

It has now emerged that this is to be a “desk-based” review (i.e. with apparently no possibility for any input by arts organisations or the public). This will strengthen the hands of those (not least the Revenue Commissioners and the 2009 Commission on Taxation) who believe that is that it now well past its sell-by date.

The scheme was first introduced in 1969 by the then Minister for Finance, Charles J. Haughey, who may or may not have hoped that it would have positively influenced a small but high-profile section of the electorate in the lead-up to the following general election. It didn’t, as the outcome of the 1973 election was to make clear.

It has since then been subjected to numerous changes, and its effects have been whittled down – often for good, commonsense reasons – while it has also been of modest assistance to at least some of the less spectacularly successful writers and artists

The first substantial amendment was in the 1989 Finance Act. This was the creation of an appeals system against refusals to grant exemption. There were more significant changes in the 1994 Finance Act, in which both the Arts Council and the Minister for Arts made their first appearance, exercising co-responsibility for authorship of new Guidelines which were then drawn up to help the Revenue Commissioners and which have remained in force, with some modifications, until the present day. The1994 Guidelines, introduced when Michael D Higgins was the relevant minister, notably increased the number of categories under which exemption could be changed, and included references to both the Heritage Council and the National Archives.

A later set of Guidelines introduced in 1997, however, included another innovation: a list of the type of work that would NOT be considered as original and creative (emphasis added). This represented, perhaps, a fight-back by interests that felt that the guidelines were too loose or too liberal. The present set of guidelines dates from 2013.

The amount of income for which tax exemption could be claimed, however, has also been subject to the slings and arrows of fortune. It was effectively unlimited until 2006, when a limit of €250,000 was introduced following a review by the Revenue Commissioners a year earlier. At that time almost 1,000 of the beneficiaries were earning less than €6,000 a year, and fewer than a dozen were earning more than €500,000, the latter category largely responsible for a revenue loss to the exchequer of almost €13 million.

In 2010 the late Brian Lenihan cut the maximum income allowable for the deduction to €40,000. By 2012 the numbers applying had fallen, and the numbers refused exemption had increased. The number of claimants has also fallen by more than 30% since 2010.

However, contrary to expectations that the scheme will be further limited, there are also some straws blowing in the wind in the opposite direction. The scheme was actually relaxed somewhat in the 2014 Finance Act, when the threshold was increased from €40,000 to €50,000. In addition, while the possibility of exemption had previously been extended to artists living in any EU or EEA State, this was further changed so that even writers and artists living outside the EU/EEA could now apply to the Revenue Commissioners for an advance opinion on whether their works would come under the scheme if they become resident in the EU/EEA.

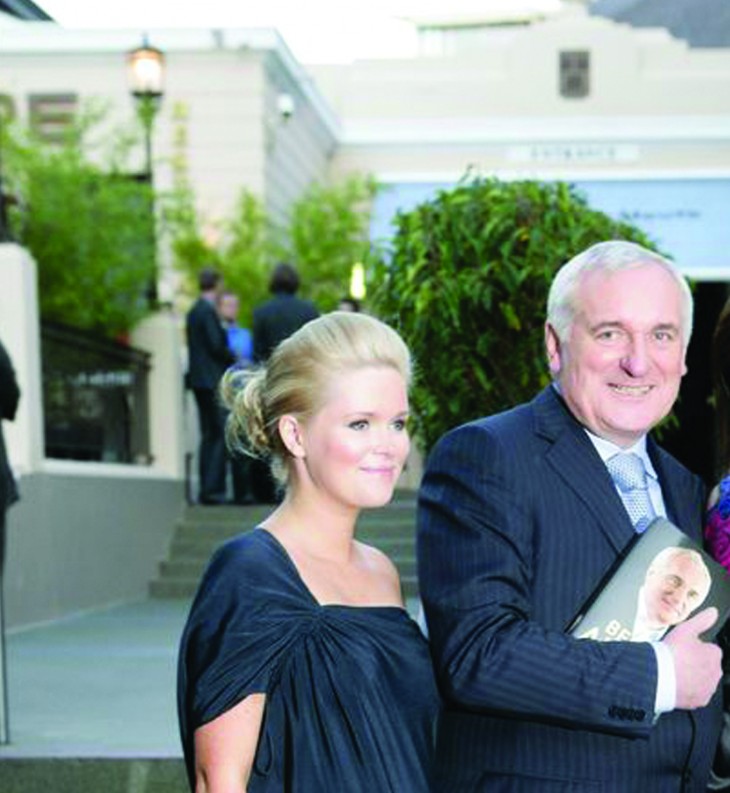

There have been rumours that in recent years the Arts Council has been concerned that the guidelines have been interpreted by the Revenue Commissioners too loosely by including celebrity biographies and the like. The latest list available on the web-site of the Commissioners is indeed a fascinating pot-pourri of names, including – along with those of well-established artists and writers of fiction – the present writer (whose biography of Mary Robinson benefited), Bertie and Cecelia Ahern, Charlie Bird, Harry Browne, George Hook, Terry Prone, and Louis Walsh. It repays a browse.

If it is to be abolished in the forthcoming 2015 Budget, as seems possible, will the additional tax revenue be spent elsewhere in the arts area, devoted to a different worthy cause, or simply pocketed by the exchequer? One way or the other, change is probably imminent. •

Professor John Horgan is a former Press Ombudsman