Fast-food delivery companies Deliveroo and Just Eat are dependent in Ireland on illegal labour that exploits international students who risk deportation by working for them.

By J Vivian Cooke.

The liveried bicyclists who zip past, delivering fast food, are probably working illegally.

The fast-food delivery platforms operating in Ireland such as Deliveroo and Just Eat are so dependent on illegal labour to effect deliveries that flouting Irish immigration and employment law is at the very heart of their business model. These companies are aware of the practices, but, rather than enforce compliance with existing law, and, for that matter, the terms of their own service contracts, Deliveroo, in particular, in a remarkable manifestation of arrogance, has actually lobbied intensively to have Irish employment law changed.

Many of the problems with the gig economy are well rehearsed: exploitative rates of pay; widespread tax non-compliance; dangerous working conditions; and a lack of the social protections that are due to most other workers. The platform companies actively avoid their responsibilities to their workers by categorising riders as self-employed. This categorisation has been challenged across Europe with varying degrees of success as differences in national legislation make the self-employment categorisation valid in some countries (UK and Ireland), but unlawful in others (Spain, Italy and the Netherlands).

However, Stamp 2 visa holders – students from non-EU/EEA countries attending approved full-time English-language or third-level courses – are only allowed to engage in casual employment for less than 20 hours per week during college terms and for no more than 40 hours per week outside of college terms. Their visa conditions are explicit: they are not permitted to engage in business or trade. It is illegal for Stamp 2 visa holders to be self-employed.

The inescapable logic of the fast-food delivery platforms insisting that their riders are self-employed is that Stamp 2 visa holders cannot legally be Deliveroo, Just Eat or UberEats riders.

Deliveroo, for one, acknowledges as much in a series of documents released to Village Magazine under a Freedom of Information request. In May 2021, Deliveroo’s Country Manager, Paddy Quinlan, wrote to the Minister responsible, Leo Varadkar, looking to change international students’ working permissions because “It is increasingly clear that the law prohibiting Stamp 2 visa holders from being self-employed has presented a significant challenge for international students”. When Deliveroo CEO, Will Shu, met Varadkar later that month, these illegal work practices were one of the items that featured prominently on their agenda; while the Department of Enterprise’s records show that, at a further meeting about the topic with Minister Damien English on 18 October 2021, “They [Deliveroo] also indicated that they had contacted the Minister for Justice regarding limitations imposed regarding working hours under certain visa permission categories”.

The inescapable logic of the fast-food delivery platforms insistence that their riders are self-employed is that Stamp 2 visa holders cannot legally be Uber Eats, Deliveroo or Just Eat riders

Yet the use of illegal labour in the industry is widespread and is facilitated by how Deliveroo designs and operates its rider Apps.

Prospective platform riders must produce documents confirming their identity and their legal entitlement to work before they are accepted as riders. However, lacking the requisite permissions and paperwork, Stamp 2 visa holders cannot sign up to be riders using their own identities. However, a feature of Deliveroo and Just Eat’s rider Apps is that approved riders are allowed to use their profiles to appoint another person to complete the account holder’s deliveries.

Nevertheless, neither Just Eat nor Deliveroo asks to see or check the substitute riders’ documents when profile owners substitute them.

Instead, Deliveroo warns its account holders that “When working with a substitute it’s your responsibility to check they have valid right to work in Ireland. This includes a valid Irish or EU passport, or the relevant visas. There are often conditions to working with visas, for example, people on Stamp 2 (student) visas are not eligible to work with Deliveroo”.

Hypocritically it notes the gravity of breaking immigration law: “Failing to carry out Right to Work checks can be considered a criminal offence with sanctions of up to 5 years of imprisonment and a fine up to €250,000, it eschews all responsibility for addressing the consequences”. This is one of the most cynical policies Village has seen.

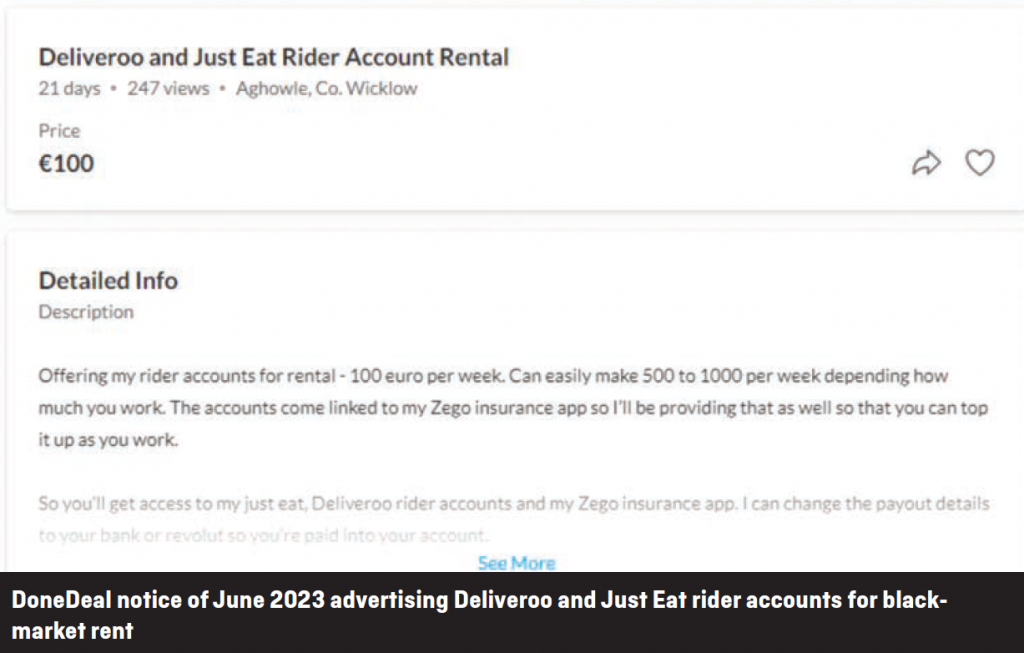

Within the tightly knit foreign-student community sometimes it is a matter of using a qualifying friend’s or relation’s profile. However, for many others, a shadow market has arisen in which valid profile owners unlawfully rent out their Deliveroo or Just Eat rider profiles to migrants who are not legally permitted to undertake self-employed work and charge them up to €100 per week for the privilege of working in miserable conditions for miserly fees.

Deliveroo self-servingly facilitates this illegal practice by allowing account holders to change the details of the receiving bank account into which rider fees are remitted. This allows fees to be paid directly into the substitute riders’ bank accounts. However, some profile owners insist that substitute riders’ fees are paid to the profile owner’s bank account and sometimes the fees earned are withheld from the substitute. In such situations, the rider has very little recourse as reporting the theft exposes them to the risk of being deported for breaching the conditions of their visa.

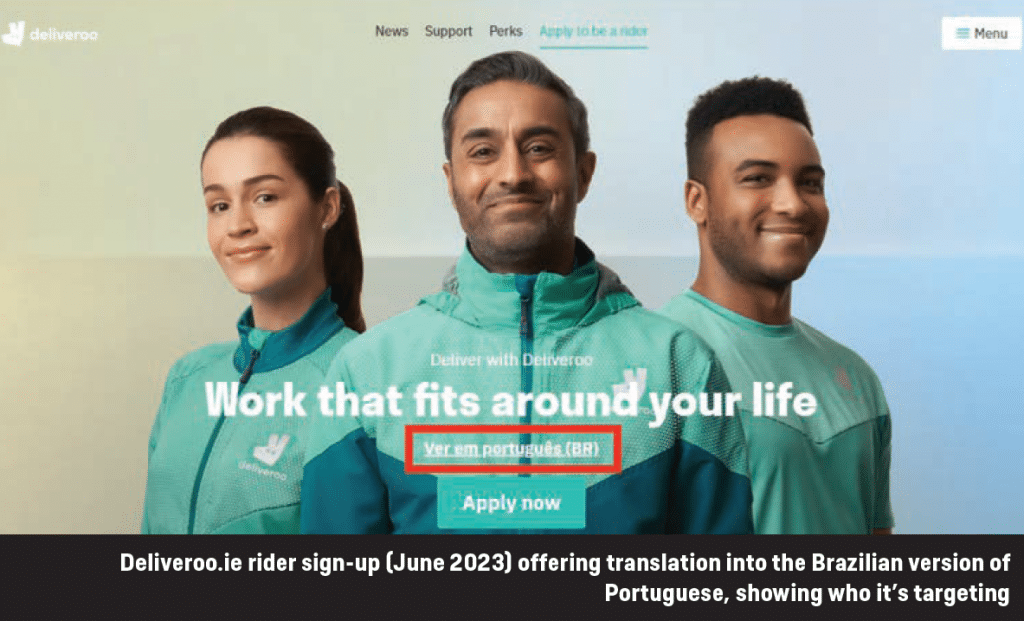

Moreover, Deliveroo’s sign-up page for riders on its Irish website is available in English and in Portuguese. Pointedly, the version of the Portuguese translation offered is the Brazilian vernacular rather than the European version. Only a very small proportion of Brazilians resident in Ireland have the legal entitlement to engage in self-employed work. The choice of vernacular offered is consistent with what Quinlan noted: “is a significant desire among Stamp 2 visa holders for work as Deliveroo riders”.

There can be no doubt that the practice is endemic. It is not possible to quantify precisely the extent of the practice because participants are predictably reluctant to admit that they work in breach of their visa conditions. Indeed, exact figures of the total number of people working as riders, either lawfully or unlawfully, can only be estimated: in a statement to Village Magazine, the Revenue Commissioners noted that “It is not possible to provide a definitive figure for the number of food delivery drivers operating in Ireland as trade descriptions on income tax returns are recorded using ‘free text’ and do not, therefore, provide for systematic grouping”. However, “In February this year, the Commissioners issued Level 1 Compliance Intervention notices to over 400 individuals engaged in the food delivery sector advising them to complete an income tax return in order to regularise their tax position” which confirms Revenue’s previously publicly expressed dissatisfaction with the level of non-compliance in the sector.

The different international student groups and networks to which Village spoke had 500 – 800 members each, but it is important to realise that only a small proportion of Ireland’s transient international student body that are working in breach of their visa conditions will have the opportunity or inclination to become involved in representative associations.

Equally, the results of interviewing riders on an anonymous basis at various pick-up points in Dublin’s city centre and suburban locations, while not definitive, is certainly suggestive of the extent of the practice. Of 123 riders approached, 98 were Stamp 2 visa holders who were using someone else’s rider profile and each knew many other people working under similar pretences. This survey methodology underestimates the prevalence of illegal working, as riders working in breach of their visa conditions will be reluctant to admit this or participate in a survey.

Telling a tale of the multinational’s relationships with Ireland and its laws, Deliveroo’s policy seems to be to ask for forgiveness rather than for permission

Deliveroo has been quick to adapt its App when it sees a commercial need. It moved swiftly its programme to prevent third-party rider support Apps such as Rodeo from obtaining Deliveroo information and it is prioritising rider face recognition to prevent the company from being defrauded. It would be a straightforward matter to require substitute riders to provide the same proofs of identity and entitlement to work, as the account holders. It is simply a matter that Deliveroo is not interested in fixing.

Whereas Just Eat operates a flexible delivery model that uses directly-employed riders, third-party courier companies, as well as self-employed riders, in different markets, in Ireland it relies only on riders who are categorised as self-employed. Just Eat notes in its 2022 Annual Report that “Our employed courier model, generally in use in mainland Europe and Israel, provides couriers with valuable benefits, such as training, holiday pay, social security, insurance, pension, and sick leave”. These benefits are not extended to its riders in Ireland.

By contrast, Deliveroo’s business, across all the markets in which it operates, is based entirely on gig self-employment: “our rider model [categorising riders as self-employed] is critical to our long-term profitability and our ability to compete effectively in each of our markets”. Such is the significance of this continued treatment of their workers that Deliveroo’s most recent published Annual Report, (2022), assesses that: “Our rider model continues to be a principal risk for the Group” to such an extent that “our business would be adversely affected if our rider model or approach to rider status and our operating practices were successfully challenged or if changes in law required us to reclassify our riders as employees including with retrospective effect”.

There is: “little appetite for what appears to be Deliveroo’s proposed à la carte and muddied approach to employment rights. . . The Department considers that compliance with the current legislation, rather than the creation of new legislation and new categories of worker, is preferable”

The company’s attitude is that it is better to ask for forgiveness than to ask for permission. Deliveroo has adopted a strategy of persevering with its self-employment model even when this model is opposed by its workers or is in breach of employment law. Deliveroo’s strategy is to deal with the consequences of being found to have broken employment law instead of complying with it. In its annual accounts, it anticipates regulatory and judicial costs of breaching employment categorisation to be in the range of £50 million to £200 million.

Such financial provision is prudent given that an Italian court imposed a dramatic initial fine of €730 million on the fast-food delivery industry in February 2021. Subsequently, Italian authorities reduced the penalty Deliveroo had to pay to €15,700 – which was separate from the millions in compensation paid to individual riders. Similarly, on 19 April 2022, a French court imposed the maximum fine allowable of €375,000 on the company and, in the same judgment, two Deliveroo managers were fined and were each given one year’s suspended jail sentence.

Deliveroo cannot survive if it is unable to treat its riders as self-employed. As a result, the company withheld its own offer of better protections and conditions to its Irish riders, because, as a civil service commentary on its August 2019 written submission noted: “their concern is that the more benefits they confer on riders, the more likely it is that the Department will find them to be employees rather than self-employed”.

Deliveroo’s international corporate strategy is to pre-empt adverse regulatory or judicial interventions by extensive lobbying for changes to employment law. As its Annual Report euphemistically notes: “Deliveroo constructively engages with regulators and policymakers on a range of issues in all of our markets”. Deliveroo has made numerous direct representations to the government and, since 2019, has paid lobbying firm, Hume Brophy, to pepper parliamentarians across the political spectrum with policy and position papers, but the results have been mixed.

The civil service appears largely unpersuaded by the company’s entreaties. An official briefing note observed that there is “little appetite for what appears to be Deliveroo’s proposed à la carte and muddied approach to employment rights…The Department considers that compliance with the current legislation, rather than the creation of new legislation and new categories of worker, is preferable”.

In its submission to the Commission on Taxation and Welfare and in testimony to Oireachtas committees, Revenue has expressed its dissatisfaction with how taxes on rider fees are declared, proposing instead that Deliveroo should combat widespread non-compliance by withholding income tax from its rider payments.

An internal Departmental briefing paper to Leo Varadkar made it clear that: “To consider allowing Student Stamp 2 holders to become self-employed would move them out of Stamp 2 conditions altogether” [and that] “Providing a right to become self-employed for any one cohort will also result in similar requests from other groups”.

Although the Department of Social Protection officially rejected Deliveroo’s ‘Charter for Flexible and Secure Work’ on the grounds that: “There is no clear benefit in creating a third category of worker in Ireland which could arguably constitute an undermining of the existing safety net of employment rights”; a number of government parliamentarians have endorsed this discredited idea. The Deliveroo proposal complements Fine Gael’s policy of “making work pay and encouraging self-employment and entrepreneurship so as not to interfere in commercial relationships beyond what is necessary”.

Meanwhile, Fine Gael’s embarrassing pliancy to the demands of tech multinationals is fully evident in Shu’s expression of appreciation for: “your [Varadkar’s] comments in the meeting that your intent is not to undermine the ability of businesses like Deliveroo to operate, which I know is welcomed by our company as well as by our riders and restaurant partners”.

Until this government summons the political will to enforce Irish law, vulnerable and struggling migrants will be trapped in an exploitative shadow economy. Platform companies continue to cut rider fees and, from this reducing income, international students must pay a weekly ‘rent’ to profile owners. Because of their precarious immigration status, these riders are excluded from the legitimate economy and feel that they have no recourse to legal protections.

When he was Minister for Enterprise, Leo Varadkar repeatedly publicly encouraged the growth of the gig economy in Ireland while at the same time, he was remarkably complacent in tackling the illegal practices which thrive on these platforms. But the protection of vulnerable riders should not be a matter of dogmatic ideology.