The Fourth Defendant in the recent rape trial of rugby players in Belfast was Rory Harrison of Manse Road Belfast. He was acquitted of perverting the course of justice by lying to police when he gave a witness statement about his dealings with the complainant woman and deliberately omitting information. He was also acquitted of withholding information from the police. After dropping the woman home and walking her up her driveway, the court heard Mr Harrison texted the woman: “keep the chin up you wonderful woman” and she said she had absolutely no complaint against him. The day after the incident Harrison wrote to Blane McIlroy: “Mate the scenes last night were hilarious. Walked upstairs and there were more flutes than July 12”.

Rory who has lived in Dublin and played as prop for UCD and Terenure College Club, is the son of Terence Harrison, a solicitor and partner in Harrison & Hardstaff, 7 Donegal square West Belfast. A former partner is Ian Hardstaff, current Master of the High Court in Belfast.

Terence Harrison is the present sole director of TMKK limited, a property company registered in Belfast and incorporated on 13 February 2001.

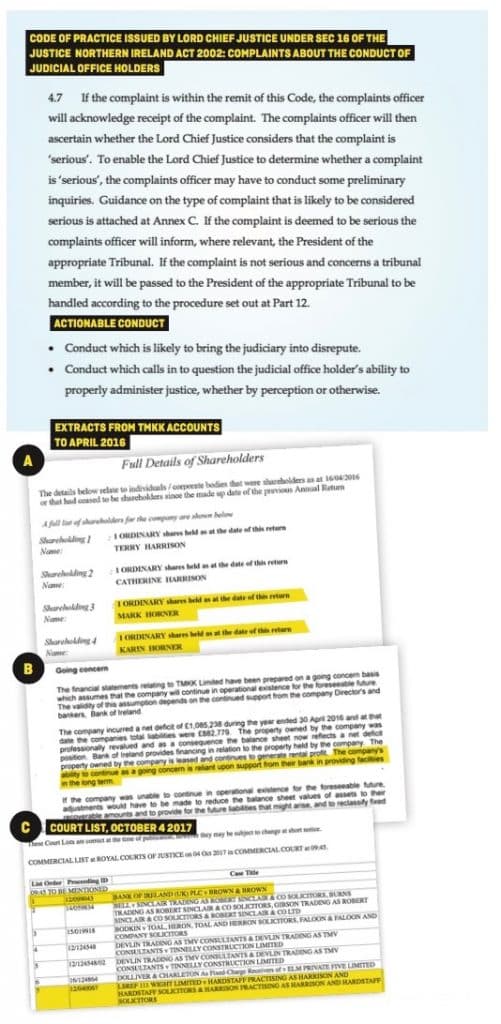

TMKK limited came to prominence last year when a lay litigant was defending an action by Bank of Ireland which was seeking repossession of some property in Northern Ireland. The action had taken nearly four years and was finally heard by Judge Horner. At the very last moment in March 2017 the litigant in question received information, quite accidentally, that the Judge was a shareholder and former Director of TMKK limited; that his wife Karin Horner at that time was a director; and that the company was grossly indebted to the Bank of Ireland, having borrowed substantial sums to fund the purchase of property in Belfast.

Checking the records in companies house it was discovered that not only was the company indebted to the Bank but that in 2016 its assets had been devalued from £2,0650,40.00 to £950,000.00, having remained unchanged in value since mortgages were taken out in 2007 when Judge Horner was a QC – barrister – and Director of the company.

Property values generally in Northern Ireland had collapsed in that same period but, uniquely, not those owned by TMKK limited. In the notes to the 2016 accounts it was stated that the company was considered a going concern only because of the support of Bank of Ireland: it is questionable whether or not the company was trading while insolvent and whether the value of its assets was properly reported between 2007 and 2016. If its directors knew that the value of the assets was being overstated further issues might arise.

The lay litigant brought these matters to the attention of Judge Horner forcing him to recuse himself from the trial while, bizarrely, claiming that he was doing so not because he had been caught out in a manifest conflict of interest that he had not disclosed but because the defendant would not accept any judgment he made.

On 14 March the lay litigant made an official complaint to the lord chief Justice’s office but has not yet received a substantive reply, as the office seems wrongfooted. The Lord Chief Justice’s office still seems nowhere close to convening the Tribunal envisaged in the Code of Practice on Judicial complaints. It has produced increasingly forlorn excuses as to why this has not happened.

On 27 March 2017 Justice Horner recused himself from the lay litigant’s case giving a statement saying that the reason he recused himself was because the litigant in person would not accept his judgment. This is judicial nonsense. No judge ever should doubt the acceptance of his judgment by a party.

The Lord Chief Justice’s office told Village: “Mr Justice Horner stated in open court that he was recusing himself in the case involving the Bank of Ireland and the lay litigant. He said he was satisfied that there was no question of actual bias or that he had any conflict of interest in the case, but that it was apparent to him that ‘the party would never feel able to accept [his] verdict’”.

Judge Horner was forced to recuse himself from another long-running trial involving Bank of Ireland at the same time. In that case it was the Bank that asked him to recuse himself and not the other party: he admitted to counsel involved that he was “seriously under water” with the Bank. It appears that he may have given a personal guarantee or guarantees to the Bank to cover at least part of the company’s borrowing in the normal way and that with the company now a loss-making venture those guarantees would fail to be paid.

It is the belief of the litigants and of the NI Bar, where this subject is still hot news, that the Bank was well aware of the conflict of interest as were the solicitors then instructed. The failure by the judge to raise the conflict of interest is seen as a very serious matter and the later application by the Bank itself that he recuse himself from a case in which things were not going well for the Bank is seen as scandalous. A question remains as to whether the Bank did not raise the issue of his conflict of interest in cases that were going well for it: if that were the case then it would be shockingly serious for the administration of justice.

Further questions remain as to how many other judicial officers including those holding the office of master or similar in NI are or ever have been in the same position as Judge Horner and the extent of the potential hold that the Bank of Ireland, and other banks, may have over others. Bank of Ireland still holds a charge over the assets of TMKK limited of which Terence Harrison is now the sole director. There can be little doubt that officials of the Bank will have been well aware of this in the course of the recent rape trial as it was already widely known outside legal circles.

Meanwhile it is alleged that, as a sponsor of Ulster Rugby, Bank of Ireland came under serious pressure to distance itself from the recalcitrant rugger buggers. “Bank of Ireland is highly concerned regarding the serious behaviour and conduct issues which have emerged as a result of the recent high profile trial”, it stated. “The Bank has formally conveyed these concerns to the ceo of Ulster Rugby. It is of paramount importance to Bank of Ireland that our sponsorship activity aligns with and supports our core values, and reflects positively on Bank of Ireland through association”.

In the end pressures of all sort led Ulster Rugby to cancel its contracts with two of the acquitted rugby players. What old man Harrison thinks of it all would presumably be unprintable.

Michael Smith